A trillion dollar lift off in the commercial race for space

As recession looms over the UK economy, investors will be asking: what sectors will be resilient against the headwinds of economic downturn? Conventional wisdom points to those companies, industries, products, or services that we cannot live without, such as healthcare, consumer staples and utilities. But perhaps surprisingly, the space industry is also tipped to be largely recession proof.

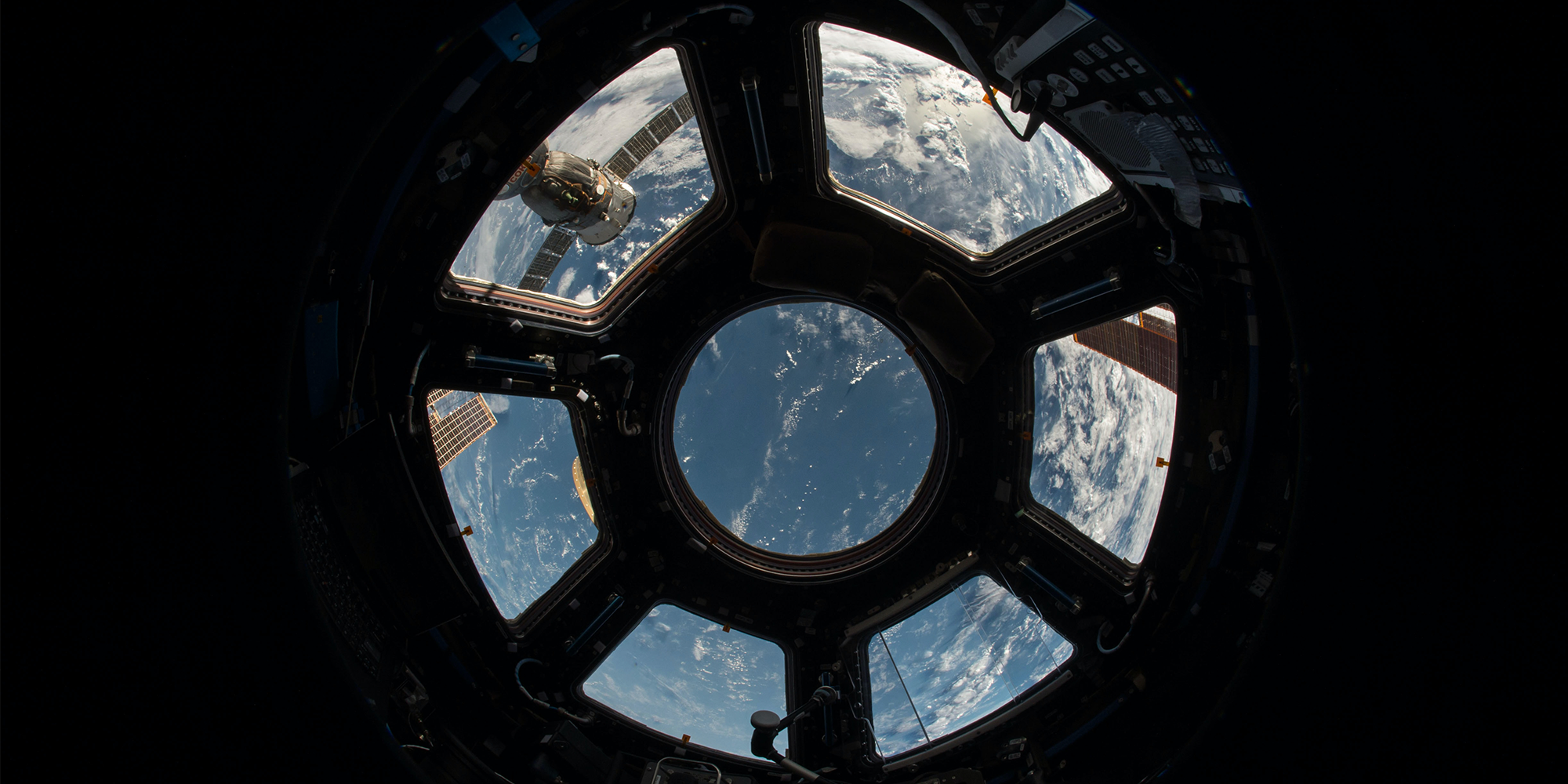

Whilst the media grabbing headlines of space tourism or a failed rocket launch often portray an industry characterised by mystique and adventure, the less glamorous technologies that make modern space exploration and exploitation possible will prove fundamental to modern living, and indeed statecraft. From providing location data to mapping weather patterns, natural disaster prevention to protecting national security, everyday life and traditional industries are likely to be the primary beneficiaries of space enabled transformational change.

State-driven endeavours into outer space were a key battle ground of the Cold War. The commercial battle, dubbed ‘New Space’, has become a new field of competition for nations and private companies alike, with the battle for supremacy having rumbled along for well over a decade. Governments around the world are racing to secure their foothold in this evolving domain, recognising the sector’s economic and strategic potential. Or to quote from Policy Exchange’s Space Unit, the first of its kind at any UK think tank, “UK commercial space is not just another commercial market that should be left to the vagaries of a global market, but is a strategic sector of national security interest and importance that provides critically needed technologies and services”.

Slice of the economic pie

At present, the UK space industry generates £16.5 billion annually, more than a trebling since 2000, and space technologies now underpin £360 billion per year of UK economic activity. Globally, the space market is expected to increase from $339billion (2016) to $2.7 trillion by 2045, a figure comparable to the economic might of the oil industry today, which represents nearly 4% of the global economy. The UK economy is well placed to benefit from this future trillion-dollar industry with a 5.1% foothold already established in the global market. However, if the UK wants a large slice of this lucrative pie, it will need to take a leading role in shaping the development of the global space industry, continue to expand and build new spaceports, as well as attract companies to locate in the UK.

Opportunities for investors

Investors have witnessed an inflection point within the space market. Venture capital continues to back start-ups at record levels year on year, creating a generation of companies with proven space technologies. Now is the time for more traditional investors to identify clear revenue raising growth opportunities and scalable space technologies. The investment risk is less about the viability of new space technologies and more about the execution of scaling up and expanding. For institutional investors, it is now a question of capital allocation and portfolio exposure, or rather how big their appetite is to back the space industry when up against other sectors of the UK economy. Reflecting this inflection point, the private equity fund, NewSpace Capital, the first of its kind focusing on the growth stage of space enterprise, recently closed a funding round raising €100m.

Unresolved political risks

The UK has played a formative role in continental Europe’s space architecture as a founding member of the European Space Agency, the principal intergovernmental organisation that cultivates policies, develops programmes and administers funding for the space industry. Crucially, whilst independent from the European Union, it is inextricably linked in administrating the EU’s space and funding programmes. Despite the Brexit withdrawal agreement reached in January 2020, the EU continues to leverage UK participation and access to Horizon Europe, the €95.5 billion funding programme for research and innovation for 2021-2027, and Copernicus, the EU’s Earth Observation Programme, against the outstanding political issue of the Northern Ireland Protocol.

As stated by EU Commissioner Mariya Gabriel in October 2022, UK participation and access is ‘linked’ to (potentially conditional on) resolving the issue of the Northern Ireland Protocol. This political obstacle may be resolved by Rishi Sunak in 2023 as he adopts a more conciliatory approach when compared to his predecessors. For however long the uncertainty remains over the UK’s participation in Horizon Europe and Copernicus, it is damaging for both the UK and EU. Just as waiting in limbo risks the UK falling behind, there also exists a gaping hole in the EU’s planned investments without the UK’s contribution. This is particularly true given the US and China sizeably outspend the UK and EU as a percent of GDP. In the short-term, there are three possible outcomes:

- Resolving the Northern Ireland Protocol and the UK enjoys full participation and access in multi-national European space programmes.

- Prolonged uncertainty to the detriment of the UK space sector.

- Or ‘Plan B’ – a flagship national space programme and alternative cooperation with the UK’s Indo-Pacific partners and/or the Five Eyes countries.

Space falls within the remit of George Freeman, Minister for Science, Research and Innovation, and a former biomedical venture capitalist. In response to industry concerns about waiting in limbo, Freeman recently made available £200 million of the UK’s original £750 million commitment to Copernicus, demonstrating the Government’s willingness to be proactive in remedying some of the immediate bottleneck issues. In total, the Government committed £615 million to the European Space Agency, £217 million to global exploration programmes, £206 million to telecommunication, £111 million to space safety and security, and finally, £71 million to new technologies in November 2023. In addition, funding settlement increased in length from one to three years, a strategic decision for an industry that typically works toward longer timescales.

The House of Commons Science and Technology Committee has a less optimistic take on the UK’s position and approach to space. A recent inquiry found the Government wanting on several fronts and was critical of the Government’s sizeable stake in rescuing the once bankrupt company OneWeb, as well as its decision against developing a new sovereign sat-nav constellation. The Committee called for additional funding – perhaps to compete with that of China and the US – as well as for the Government to publish what a ‘Plan B’ might look like in the event that the UK is no longer granted participation and access to the EU’s space programmes.

Whilst the Government’s November funding announcement brings added certainty for the space industry, further increases in funding is highly unlikely given the cost-of-living crisis and pressure on the public finances. The mood music, however, is changing around the Northern Ireland Protocol with hopes of an imminent resolution, thereby enabling the combined heft of the UK and EU to collaborate on space. Nonetheless, the appetite for space technology will likely weather the UK’s economic recession and with a maturing space market, private investment will be mission critical to ensuring an economic lift off for the next trillion dollar industry.